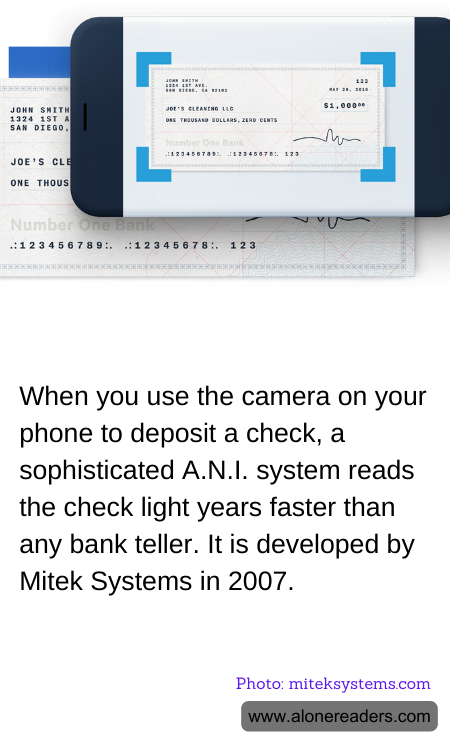

In recent years, the integration of Artificial Narrow Intelligence (ANI) into everyday banking operations has revolutionized the way we handle financial transactions, particularly in how we deposit checks. One notable implementation of this technology is the mobile deposit feature that has become a staple in mobile banking apps. This feature allows users to deposit checks into their bank account simply by taking a photograph with their smartphone's camera, a process that is not only user-friendly but incredibly efficient.

The technology behind this convenient feature is primarily attributed to Mitek Systems, which developed the mobile deposit technology back in 2007. Since then, it has dramatically transformed the banking experience for millions of customers worldwide. The underlying ANI system is designed to quickly and accurately read and process the information contained on a check. This system uses advanced image processing and pattern recognition algorithms to capture and interpret the handwritten and printed text on checks, including the payee's name, the amount, and the signature.

This instant processing is significantly faster than the manual entries previously required during physical visits to a bank or even via older digital interfaces. For banks, this means a drastic reduction in the costly manual labor associated with check processing. For customers, it equates to a much quicker, convenient banking experience without the hassle of physical queues.

Moreover, the security features embedded within the ANI systems are robust, involving various authentication layers that minimize the risk of fraud. Checks are validated for authenticity, and any discrepancies are quickly flagged for further review. This level of security is imperative, especially in an era where cyber threats are increasingly prevalent.

The impact of mobile check deposit technology extends beyond just consumer convenience and bank operations efficiency. It has also played a significant role in financial inclusion, enabling banking services in rural and underbanked areas where branch access is limited. People can now complete transactions from anywhere, at any time, right from their smartphones.

As we move further into the digital age, the potential for AI and its subsets like ANI in banking will undoubtedly continue to expand. This could pave the way for more personalized and instantaneous banking services, reshaping our financial landscape even more profoundly. The success story of Mitek Systems and its mobile deposit technology is just an early chapter in what promises to be an exciting evolution of the banking sector, driven by artificial intelligence.