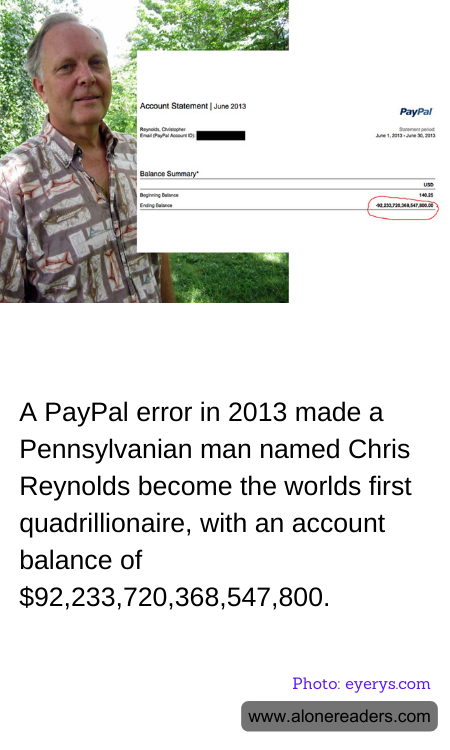

In 2013, a mind-boggling PayPal error unexpectedly propelled Chris Reynolds, a Pennsylvanian PR executive, into the financial stratosphere, momentarily making him the richest man in the world. Chris, who typically used PayPal for small transactions, was stunned when he logged into his account and discovered a credit of $92,233,720,368,547,800. This astounding figure made him a quadrillionaire, the first ever known in human history.

The surreal experience, however, was short-lived. When Reynolds logged into his account a second time, PayPal had corrected the error, and his balance had returned to its normal state. Intrigued and amused by the incident, Reynolds contacted PayPal to inform them of the anomaly. PayPal acknowledged the error, attributed it to a glitch, and assured that their systems were being corrected to prevent such occurrences in the future. Although Reynolds did not get to keep any of the fictitious funds, the incident garnered significant media attention, highlighting potential vulnerabilities in digital transaction systems.

This unusual event opened up discussions about the reliability and security of digital money management platforms. While no real harm was done in this instance, it served as a reminder to the financial services community about the importance of maintaining robust and secure systems to handle transactions. It also raised questions about what safeguards are in place to prevent similar incidents that could potentially have more serious consequences.

Chris Reynolds took the experience in good spirits, jokingly suggesting how he would spend his quadrillions if they were real. His brief financial rollercoaster ride became a humorous anecdote and a cautionary tale about the reliability of digital technology in managing and transferring wealth. Despite the initial shock and potential implications, this incident serves as a fascinating footnote to the digital age, illustrating both its possibilities and its limitations.