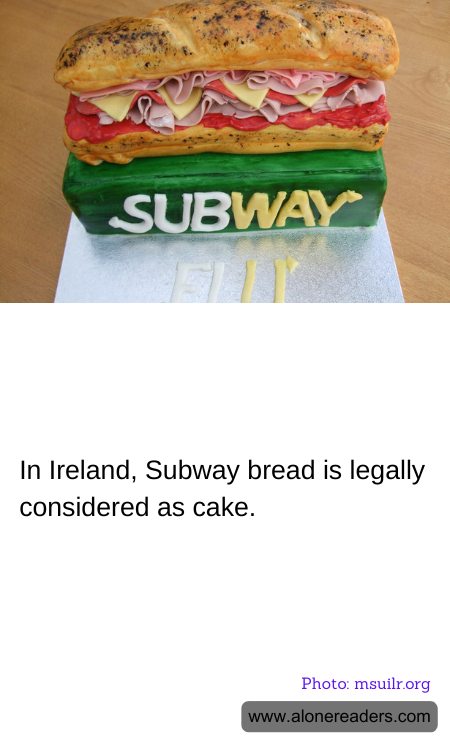

In a ruling that surprised many, Ireland's Supreme Court declared that the bread used by Subway, the American fast-food chain known for its sandwiches, does not meet the legal definition of bread and should rather be classified as a confectionary or a cake due to its high sugar content. This decision emerged from a case involving a Subway franchisee, Bookfinders Ltd., which sought a VAT (Value-Added Tax) exemption for their sandwich breads. According to Irish law, staple foods like bread are exempt from this tax.

However, the law stipulates that for bread to be considered a staple food and thus qualify for tax exemption, the sugar content must not exceed 2% of the weight of flour included in the dough. The court found that Subway's bread contains sugar content equal to about 10% of the weight of the flour, far exceeding the limit. This high sugar content led the court to classify Subway's bread as a non-staple, essentially likening it to a cake or pastry, which are subject to the standard VAT rate.

The ruling highlighted the different standards and definitions that can apply in food labeling and taxation. It drew attention worldwide, sparking discussions not only about tax policy but also about nutritional content and consumer awareness in food products. While the ruling specifically applies to tax status under Irish law, it also prompted broader debates on what constitutes 'bread' and how food regulations affect perceptions and choices. For Subway, the outcome was significant, as it meant their bread could not be considered a tax-exempt food staple in Ireland, potentially affecting pricing and menu composition.

Subway has responded by stating that their bread is, of course, bread by any culinary standards and that they have been baking fresh bread in their stores for over three decades. However, the case remains a fascinating example of how different regulatory frameworks can impact business operations and the classification of everyday items. This case also serves as a precedent and reference in discussions about food regulations, highlighting the complexity of food law and the ingredients that go into seemingly simple products. Such incidents underscore the importance of understanding and navigating local laws for international businesses.