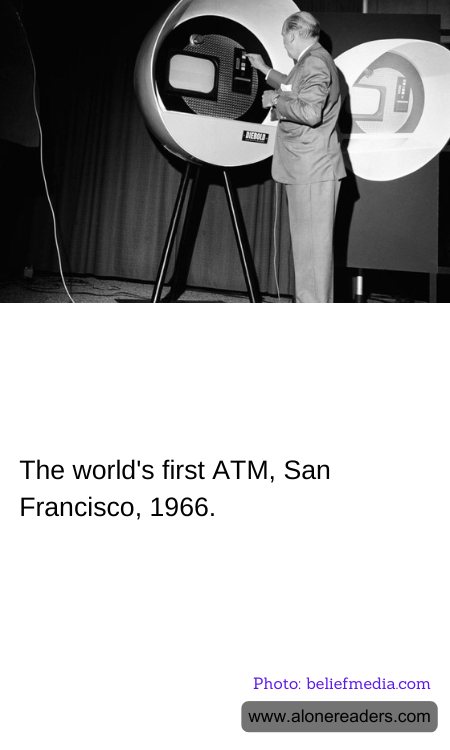

The world's first Automated Teller Machine (ATM), sometimes credited to have been installed in 1967 in London, actually has its roots tracing even further back to a previous development in the United States, specifically in San Francisco, 1966. However, this origin tale remains less recognized than that of the machine installed by Barclays Bank in London. The San Francisco machine was a primitive form of the modern ATM and marked a significant milestone in the history of banking technology.

The device in San Francisco was developed by Luther George Simjian, who had already patented an earlier version of the machine in the 1930s. Although it could not dispense cash, it allowed customers to make deposits outside of normal banking hours. The main limitations of this early version were its inability to connect real-time with the bank’s account databases and its failure to dispense cash directly to users. However, it laid fundamental groundwork for future developments.

By the time the 1960s rolled around, technology had advanced sufficiently to revisit Simjian’s idea. The 1966 machine heralded the first step towards electronic banking, employing basic mechanical components for transaction processing. It featured secure processes that authenticated a user mainly through a coded card, slowly evolving into the magnetic coding technology that became standard.

Despite its innovative approach, widespread adoption of ATM technology did not happen immediately. The concept initially faced skepticism from banks and customers alike, who preferred human interaction and were wary of electronic processes. It was only after the economic pressures and the drive for convenience in the subsequent decades that the real value of the ATM began to be fully recognized.

The ATM revolutionized banking, influencing not just economic practices but also everyday life by providing unprecedented 24/7 access to cash. Today, ATMs serve numerous functions beyond cash dispensers: they allow for deposits, fund transfers, bill payments, and even complex transactions that were once the sole domain of bank tellers. Reflecting back on its origins from the primitive machine in San Francisco, the evolution of the ATM encapsulates a significant advancement in both technology and customer service, reshaping our approach to personal and business finance globally.