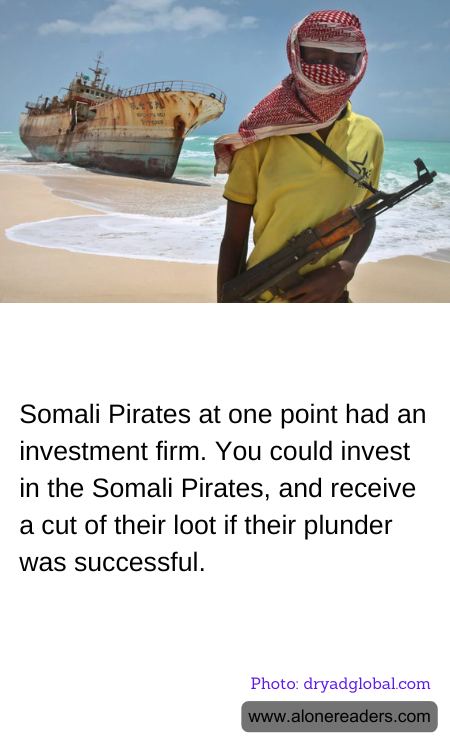

The phenomenon of Somali piracy, which peaked between the mid-2000s and early 2010s, presented a unique instance of organized crime on the high seas. In an unusual twist to their sea-bandit paradigm, these pirates, operating primarily off the coast of Somalia, established what could only be described as a rudimentary but functional investment "firm." This scheme allowed individuals to invest in pirate ventures with the promise of sharing in the profits from successful hijackings and ransoms.

Somalia, during this era, faced severe political and economic instability. With the collapse of its central government in 1991, the nation spiraled into chaos, making its waters an ideal ground for piracy. The lack of effective governance and opportunities, combined with the strategic location near one of the world’s most bustling maritime routes, contributed to the rise of piracy. Local fishermen, initially trying to protect their waters from foreign trawlers, eventually saw piracy as a lucrative opportunity given the weak law enforcement on the seas.

The investment operation worked similarly to a modern startup funding round but in a lawless framework. Investors—locals, members of the diaspora, and even some foreign entities—would contribute funds to purchase weapons, skiffs, and supplies necessary for piracy operations. In return, they were promised a portion of the ransom money obtained from hijacked vessels. The appeal was significantly high due to the often substantial ransoms demanded from global shipping companies.

This financing method indicated a sophisticated level of organization within pirate groups. It wasn’t merely a disorganized band of marauders but a calculated enterprise that assessed risk, managed resources, and maximized profits. The “shares” in these pirate ventures were sold based on the expected return from future raids, functioning almost like futures trading in the commodities market.

As international attention grew, so did the response to curb these activities. Naval patrols by multinational forces increased, security measures on ships were heightened, and efforts were made to restore political stability in Somalia. Gradually, these measures, coupled with internal disputes and pressure on investors, led to a significant decline in piracy incidents off the Somali coast.

Though the brief era of pirate "investment firms" has dwindled, it remains a fascinating study of how dire socioeconomic conditions can lead to unconventional forms of financial activities and the lengths to which desperate communities might go to survive in a globalized world.