The relationship between consumer confidence indices and retail spending trends during 2025's unprecedented tariff environment reveals a complex, multifaceted dynamic that challenges conventional economic wisdom. While consumer confidence indices—particularly the Conference Board Consumer Confidence Index and University of Michigan Sentiment Index—typically predict consumer spending, the 2025 tariff episode demonstrates significant divergences between sentiment and actual purchasing behavior. Following the April 2 "Liberation Day" tariff announcements, consumer confidence plummeted to its lowest level since May 2020, yet retail spending remained surprisingly resilient through mid-year before gradually deteriorating. This paradox reflects distinct consumer segments pursuing divergent strategies: higher-income households maintained elevated spending despite sentiment pessimism, while lower-income consumers exhibited pronounced restraint. The analysis reveals that during tariff-driven economic uncertainty, income inequality, wealth effects, employment expectations, and specific product category dynamics fundamentally reshape the traditional consumer confidence-to-spending transmission mechanism.

Consumer Confidence and Retail Sales Throughout 2025: The Impact of Tariff Policy Volatility

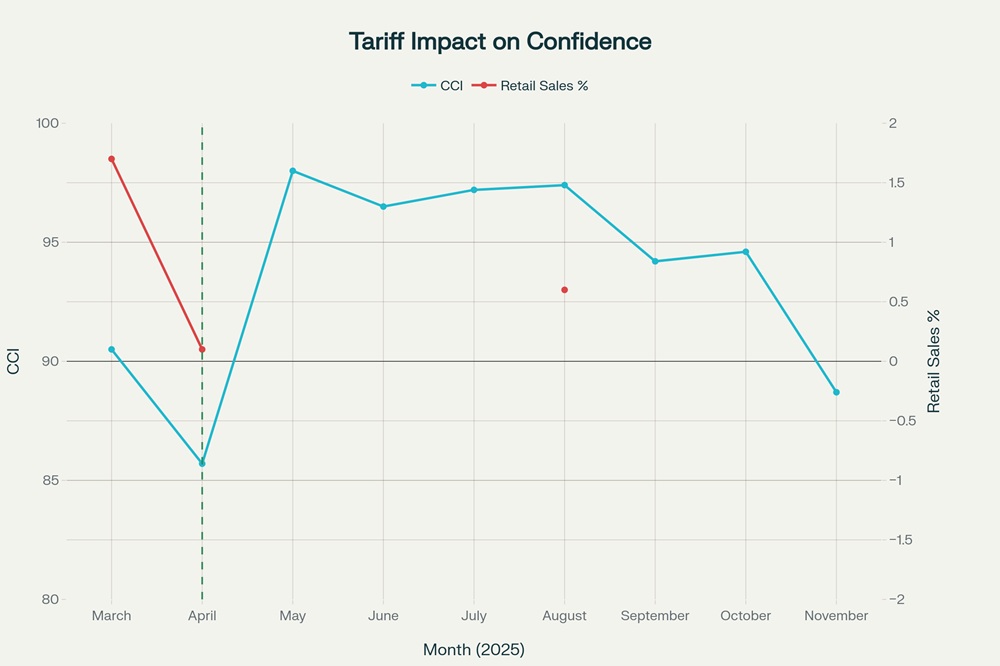

The most dramatic consumer sentiment decline of 2025 occurred in response to President Trump's sweeping tariff announcements on April 2. The Conference Board's Consumer Confidence Index plummeted from 97.9 in March to 85.7 in April—a devastating 12.2-point drop that represented the lowest reading since May 2020 and triggered widespread recession warnings among economists. The University of Michigan Consumer Sentiment Index similarly collapsed to its second-lowest level ever in April, with year-ahead inflation expectations jumping to 6.5%, the highest since the early 1980s. This synchronized decline across multiple confidence indices underscored the severity of consumer anxiety regarding trade policy volatility and anticipated price increases.

The immediate cause of this confidence shock stemmed from Trump's announcement of a sweeping tariff architecture: broad reciprocal tariffs beginning at 10% on all imports, with rates escalating to 145% on Chinese goods before moderating to 30% following negotiations. The tariff announcements were characterized by extreme volatility and unpredictability, with tariff rates fluctuating on nearly a weekly basis throughout April and May, creating what economists described as "tariff whiplash". The Yale Budget Lab estimated that by mid-April, the effective U.S. tariff rate had surged to 28%, compared to just 2.4% in early January—the most dramatic change in tariff policy in decades.

Critically, consumer expectations about the future deteriorated even more sharply than current conditions. The Conference Board's Expectations Index—measuring six-month outlooks for income, business, and employment—crashed by 12.5 points from March to April's 54.4, representing its lowest level since October 2011 and triggering the conventional recession signal threshold of 80. Among survey respondents, 32.1% expected employment to decline over the next six months, approaching Great Recession levels. This collapse in future expectations proved particularly ominous given that research confirms consumer expectations are effective leading indicators for predicting consumer expenditure.

Despite the historically severe consumer confidence collapse, retail spending exhibited surprising resilience in the months immediately following the tariff shock. This apparent paradox reflects two distinct but interconnected consumer behaviors: front-loading purchases ahead of anticipated tariff-driven price increases, and heterogeneous responses across income groups. Understanding this divergence requires examining both the timing dynamics of tariff pass-through and the concentration of spending power among wealthy households.

In March, prior to the April 2 tariff announcements, consumers accelerated their purchasing in anticipation of upcoming price increases, with retail sales surging 1.7%—the largest monthly gain in over two years. This front-loading phenomenon was most pronounced in tariff-sensitive categories: automobile sales jumped 5.1% in March, as consumers rushed to purchase vehicles ahead of the April 3 implementation of 25% tariffs on auto imports. Electronics retailers reported surges of 1.5% in March sales and 0.3% in April, as consumers stockpiled products subject to China-related tariffs. High-ticket durable goods and discretionary items concentrated most of the pre-tariff surge, reflecting strategic purchasing behavior among households with sufficient income and credit access to execute this financial maneuver.

Following this March surge, retail sales moderated dramatically in April to just 0.1% month-over-month growth, but crucially, they did not contract despite the confidence collapse. This stability in aggregate retail spending masked profound compositional shifts. Excluding automobiles, April retail sales growth was essentially flat, suggesting that the March vehicle surge represented a time-shifting of demand rather than sustained consumption growth. Yet the remarkable finding is that consumers did not significantly curtail overall spending despite confidence reaching five-year lows.

This apparent decoupling between sentiment and behavior reflects a critical economic phenomenon: Federal Reserve researchers directly examining the link between verified spending and survey sentiment discovered that consumers frequently report pessimistic sentiment while maintaining or increasing actual spending. This occurs because consumers weight inflation expectations more heavily than income considerations when assessing their economic conditions, particularly during inflationary episodes. The Federal Reserve analysis found that despite deteriorating sentiment scores, most respondents reported higher household incomes in 2024 versus 2019 and continued spending accordingly, even though in sentiment surveys they stated they "did not feel good about the economy".

Income-Based Divergence in Consumer Spending Growth: 2025 Tariff Era Analysis

As the acute tariff shock subsided and policy uncertainty moderated, consumer confidence indices experienced substantial recovery from their April lows. The Conference Board Consumer Confidence Index rebounded spectacularly in May, rising 12.3 points to 98.0—recovering approximately 93% of its April collapse within a single month. This recovery coincided with Trump's announcement of a 90-day tariff negotiation pause with China and preliminary trade agreements with the United Kingdom, which economists identified as critical confidence-restoring developments.

The University of Michigan Consumer Sentiment Index demonstrated even more dramatic recovery. In June 2025, this closely watched gauge surged to 60.5, marking a remarkable 15.9% monthly gain and a substantial recovery from depressed May levels. This surge reflected rapid downward revisions in inflation expectations: consumers significantly reduced their one-year-ahead inflation forecasts to 5.1%, the lowest level since 1981, compared to April's alarming 6.5%. Joanne Hsu, the survey director, noted that "consumers appear to have calmed somewhat from the shock of the exceptionally high tariffs announced in April and the policy fluctuations that followed," though she cautioned that they "still recognize significant downside risks to the economy".

During the May-August stabilization period, retail sales growth resumed a measured but positive trajectory. Retail purchases increased 0.6% month-over-month in both July and August, and this growth was broadly based: nine of thirteen retail categories posted increases in August, with particularly strong gains in online retailers, clothing stores, and sporting goods, likely reflecting back-to-school shopping. The Conference Board noted that June retail sales "show consumers were still spending amid the first signs of tariff pressures," though "signs of slowing are emerging, particularly in categories most affected by tariffs".

Importantly, the recovery in consumer confidence indices during this period corresponded to increasing consumer willingness to engage in discretionary spending. McKinsey's May 2025 survey found that net sentiment had dropped 32 percentage points from the previous quarter, but this represented recovery from the April lows. Deloitte research noted that consumer sentiment, though still subdued relative to historical norms, had improved sufficiently to support modest spending increases on discretionary goods.

Yet critical warning signals emerged even during this apparent stabilization. The Conference Board's Expectations Index remained persistently depressed, never rising above 74.8 during the entire May-August period, stubbornly below the 80 threshold that historically signals recession risks. Despite the surface-level sentiment recovery, consumers remained fundamentally pessimistic about future employment prospects, business conditions, and income growth. As Stephanie Guichard, senior economist at the Conference Board, stated: "Consumer confidence has stabilized since May, rebounding from April's plunge, but remains below last year's heady levels". The expectations component's persistent weakness indicated that consumers viewed the sentiment recovery as temporary and expected deterioration ahead.

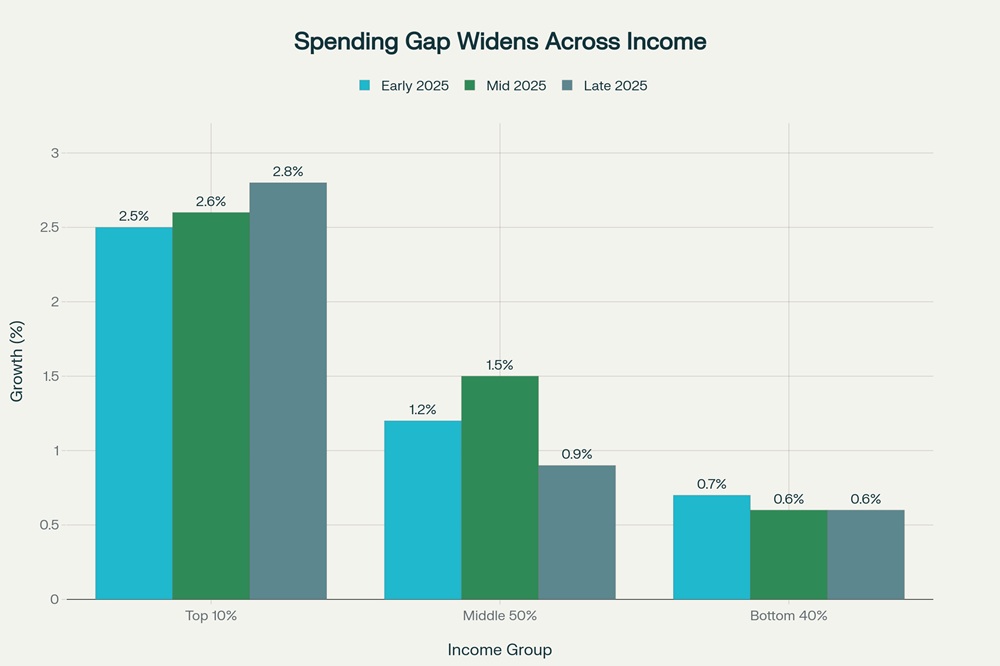

Perhaps the most consequential finding from 2025's tariff episode is the sharp divergence in spending behavior across income groups, a dynamic that traditional consumer confidence indices fail to capture adequately. While aggregate retail spending figures suggest relative resilience, this aggregate masks a bifurcated consumer economy where wealthy households sustained and even accelerated spending while lower-income households increasingly pulled back.

Data from the Bank of America Institute reveals this stark divergence starkly. In September 2025, households in the top income tercile (highest third) increased spending by 2.6% year-over-year, while the lowest tercile expanded spending by merely 0.6%. By October 2025, the top 5% of income earners showed particularly robust spending increases, while the bottom 40% showed essentially flat spending despite nominal growth. This gap represents the widest income-based divergence in spending patterns in over four years, reflecting fundamental shifts in how tariff-driven inflation and wage dynamics affect households differently.

The primary driver of this divergence is wage growth inequality. As of September 2025, wage growth for top earners accelerated to 4.0% year-over-year, while lowest-income households experienced wage growth of only 1.4%, failing to keep pace with inflation. Bank of America Institute economist David Tinsley observed: "There was a narrowing of wealth inequality coming out of the pandemic, and now it's widening". Notably, the wage growth differential between top and bottom earners had widened dramatically: in July 2025, the top tercile experienced wage growth of 3.2% while the lowest tercile's wages grew just 1.3%, the most pronounced divergence since February 2021.

This income-based divergence also reflects wealth effects operating asymmetrically across the distribution. Higher-income households disproportionately hold equities, and the strong stock market performance in 2025 generated significant wealth gains that supported spending. Research on stock market wealth effects indicates that a standard deviation increase in the stock market translates to approximately 1.7% annual aggregate payroll increases, but these gains concentrate heavily among wealthy households that dominate equity ownership. The stock market's proximity to record levels in late 2025 bolstered wealthy household spending precisely when labor market deterioration and tariff-driven inflation constrained lower-income households.

McKinsey research specifically found that higher-income households and those with dependents were twice as likely to fully understand tariff policies compared to lower-income groups. This knowledge gap meant that lower-income households often failed to anticipate price increases, instead attributing them to general inflation, potentially delaying their behavioral adjustment until price effects materialized. By late 2025, lower-income consumers were substantially more likely to switch brands (13% more than high-income consumers) and to cut back discretionary spending across fitness, sporting goods, and household appliances.

The divergence is economically significant because it challenges the assumption that consumer confidence surveys capture representative consumer sentiment. The Conference Board Consumer Confidence Index weights all respondents equally, yet 49.2% of total U.S. consumer spending in Q2 2025 originated from the top 10% of the income distribution—the highest share in data extending back to 1989. This concentration means that the spending decisions of this relatively small, high-confidence demographic can sustain aggregate retail figures while median household purchasing power deteriorates substantially.

Tariff impacts on retail spending diverged dramatically across product categories, creating a bifurcated consumer landscape where spending on essentials demonstrated resilience while discretionary categories experienced pronounced pullback. Understanding this category-level dynamic is essential to reconciling the apparently contradictory signals of declining confidence and stable aggregate spending.

The Yale Budget Lab estimated that apparel prices would rise 28% in the short run from cumulative 2025 tariffs, leather goods (shoes, handbags) would increase 29%, and textiles would jump 17%. These categories showed particularly pronounced consumer sensitivity. Simon-Kucher research found that at 5% price increases, consumers primarily shift to promotions and budget alternatives; at 10% increases, brand-switching to lower-cost alternatives accelerates; at 20% increases, consumers stop purchasing non-essentials altogether. With many apparel and accessory categories facing price increases in the 17-29% range, discretionary purchases in these categories contracted sharply.

Motor vehicle prices face substantial tariff increases—Yale estimates auto prices rise 9% in the short run (approximately $4,500 per vehicle) and 5% long-term—yet auto sales exhibited complex dynamics. The March front-loading surge (+5.1%) was followed by May's collapse (−3.8%), reflecting both the anticipatory purchasing effect and genuine demand destruction after the surge. By mid-2025, auto sales had normalized but remained below pre-tariff levels, indicating that tariffs had genuinely reduced vehicle purchases rather than merely timing-shifted them.

In contrast, food and essential household goods demonstrated remarkable pricing power and spending resilience. Food prices were estimated to rise 2.0% from tariffs—substantially below increases in discretionary categories—and consumers demonstrated willingness to absorb these modest increases. Numerator's Tariff Risk Index, tracking five variables including import reliance, tariff exposure, purchase power, sentiment, and price sensitivity, found that food groceries ranked outside the top 20 most tariff-vulnerable categories, despite food comprising a large share of consumer budgets. Households reduced spending on accessories, entertainment, and services rather than essential nutrition.

Crucially, this categorical divergence meant that aggregate retail spending figures masked severe deterioration in discretionary categories. Conference Board analysis noted that in tariff-affected sectors like furniture and apparel, businesses with weak pricing power were unable to pass tariff costs to consumers due to the discretionary nature of demand, instead absorbing margin compression. Furniture and household goods retailers reported substantial inventory challenges as consumers deliberately postponed major furniture purchases, creating forecast difficulties and potential inventory write-downs.

The categorical dynamics also revealed differential confidence impacts by product type. Consumer confidence surveys measure broad sentiment, but actual spending adjustments reflect category-specific calculations. A household might report low confidence in the Conference Board survey due to general inflation and employment concerns, yet continue purchasing essential groceries while deliberately postponing television or furniture purchases. This category-level substitution explains why aggregate spending figures from the Commerce Department showed modest continued growth even as consumer confidence indices collapsed.

Throughout 2025, the most troubling and persistent consumer sentiment signal involved labor market expectations, which remained depressed despite moderate overall confidence recovery. This labor market pessimism proved prophetic regarding Q4 2025 spending deterioration and remains the most reliable element of consumer expectations for predicting future spending weakness.

The Conference Board's labor market component—specifically measuring perceptions of "job availability" versus job scarcity—deteriorated continuously throughout 2025. The percentage of consumers rating jobs as "plentiful" collapsed from 20% in January to 6% by November, while the percentage saying jobs were "hard to find" surged from 12% to 28%. Notably, this deterioration was nearly continuous: job availability declined for nine straight months through September and remained depressed thereafter. This job-finding pessimism consistently represented consumers' primary concern alongside inflation in open-ended survey responses.

Even more dramatically, consumer expectations about future job prospects—a leading indicator component—remained deeply pessimistic. The percentage of consumers expecting employment to decline over the next six months hit 32.1% in April, nearly matching Great Recession levels, and though it improved modestly during the recovery period, it never fell substantially below concerning thresholds. As of November 2025, when confidence collapsed anew, employment expectations remained deeply negative, with Stephanie Guichard noting that "mid-2026 expectations for labor market conditions remained decidedly negative".

This persistent labor market pessimism directly suppressed discretionary spending and explains why confidence recovery in May-August failed to translate to strong spending gains. Consumer spending theory emphasizes that households consume based on permanent income expectations; if workers expect to lose their jobs or face difficulty finding employment in the future, they rationally reduce consumption even if current income remains stable. The continuous deterioration in job-finding ease throughout 2025 reflected real labor market weakness (private payroll growth slowed, unemployment ticked up modestly, and hours worked softened) that consumers accurately perceived through declining job openings and increasing delinquency rates on consumer credit and auto loans.

The critical importance of labor market expectations for predicting spending became evident in late 2025. As the Conference Board Expectations Index fell below 65 in November—the lowest level since April—consumers explicitly stated that worsening employment prospects were their primary concern. Bank of America Institute data showed that spending growth decelerated entering Q4 as labor market concerns intensified. This labor market signal proved more predictive of actual spending weakness than broad confidence indices, suggesting that granular components of consumer confidence surveys may matter more than headline indices for spending prediction.

In November 2025, consumer confidence indices collapsed anew, with the Conference Board Consumer Confidence Index plummeting 6.8 points to 88.7—its lowest level since April and significantly below May's recovery peak. The Expectations Index fell 8.6 points to 63.2, the lowest level of the year and the deepest recession signal. This November collapse was neither temporary shock nor measurement error; survey respondents reported that references to tariffs continued to increase and remained associated with concerns about higher prices, while references to the federal government shutdown, labor market weakness, and political concerns also contributed to sentiment deterioration.

Critically, the November collapse emerged despite aggregate retail sales remaining positive through September, illustrating that the consumer confidence-to-spending relationship had fundamentally shifted by late 2025. The disconnect reflected consumers' increasing recognition of structural economic headwinds: the labor market deterioration that had been signaled earlier materialized into reduced hiring and wage growth softening; tariff inflation was expected to accelerate substantially in Q4 and Q1 2026 as businesses' pre-tariff inventory ran low and new tariff-affected shipments required price adjustments; and real interest rates remained elevated, restraining borrowing and investment.

Forward guidance from economists reflected expectation that November's confidence collapse would finally translate into spending weakness. TD Bank Economics noted that "the full impact of tariffs on consumer prices is taking longer to materialize. However, tariff-driven inflation is still set to build, with core goods prices projected to rise". Citi Research warned that while consumers had absorbed approximately 30-40% of tariff costs to date, "significantly more inflation pass-through" lay ahead, expecting tariffs to increasingly bite into real incomes and reduce real spending growth in 2026.

The Yale Budget Lab estimated that households in the bottom income distribution faced average annual tariff costs exceeding $1,000, while the aggregate per-household cost reached $1,800. With modest wage growth and elevated unemployment risks, lower-income households faced the prospect of 2026 spending contraction as tariff-driven inflation materialized on grocery bills, clothing purchases, and household goods. The May Conference Board Tariff Sentiment Tracker had warned that 50% of consumers planned to postpone discretionary spending in electronics, apparel, and dining, suggesting that November's confidence collapse represented the beginning of this postponement cycle materializing into actual reduced spending.

The 2025 tariff episode provided empirical evidence refining decades of economic research on consumer confidence's predictive power for spending. Academic research consistently documents that consumer confidence helps predict consumption expenditures better than alternative indicators. Granger causality analysis finds bidirectional relationships between confidence and consumption, with confidence offering independent predictive power. Yet the confidence-spending relationship proved unstable and income-contingent during the 2025 tariff shock.

The theoretical explanation involves distinguishing between the psychological (sentiment) and material (income/wealth) determinants of consumption. Milton Friedman's permanent income hypothesis emphasizes that consumption reflects long-term income expectations, not current sentiment. During the 2025 tariff episode, higher-income households with secure employment, substantial wealth, and robust wage growth continued consuming despite sentiment pessimism, because their permanent income remained strong. Conversely, lower-income households with weak wage growth, tenuous employment, and no wealth cushion reduced consumption despite modest sentiment recovery, because their permanent income expectations deteriorated.

The wealth effect provides additional theoretical explanation for divergent income responses. Stock market performance directly influences wealthy households' spending through both direct wealth effects (higher equity values supporting higher consumption) and confidence effects (bullish equity markets signaling economic optimism). In 2025, the stock market rallied substantially despite economic uncertainty, benefiting wealthy households disproportionately. Marginal propensity to consume out of stock wealth is estimated at 3.2 cents per dollar, seemingly small but materially significant when $5-10 trillion in equity wealth is concentrated among the top 10% of households.

Finally, the 2025 experience reflects the critical importance of inflation expectations and relative income comparisons in determining spending. Federal Reserve research found that consumers who overestimated their experienced inflation relative to their actual price changes felt worse about economic conditions even when real income had improved, and that relative to recent 1970s-1980s inflationary episodes, consumers now place substantially greater weight on perceived price increases than on nominal income gains. This preference-weighting reversal explains why declining sentiment can coexist with maintained spending among those with income growth exceeding inflation: they feel pessimistic because they fixate on prices, yet spend because their income allows it.

The 2025 tariff-driven downturn fundamentally altered the relationship between consumer confidence indices and retail spending trends, revealing that this relationship is substantially more complex and heterogeneous than traditional analysis suggests. The April 2 tariff shock triggered the most severe consumer confidence decline since the pandemic, yet retail spending remained surprisingly resilient, particularly among higher-income households. This apparent paradox reflected several reinforcing mechanisms: front-loading of purchases ahead of anticipated tariff-driven price increases; the concentration of consumer spending among wealthy households insulated from tariff impacts by strong wage growth and wealth effects; divergent category-level dynamics with essential goods showing pricing power while discretionary purchases collapsed; and fundamental heterogeneity in permanent income expectations across the distribution.

Throughout 2025, income inequality emerged as the primary driver of divergent spending patterns, with wealthy households' spending accelerating despite sentiment decline while lower-income households pulled back sharply. The Conference Board Consumer Confidence Index's recovery from April's 85.7 to May's 98.0 proved temporary and misleading: the Expectations Index remained below recession-signal thresholds from February through year-end, job market expectations deteriorated continuously, and labor market concerns increasingly suppressed discretionary spending. By November, confidence had collapsed anew, and forward-looking indicators suggested that long-delayed tariff pass-through would finally materialize into consumer spending weakness during 2026.

The relationship between consumer confidence and spending proved contingent upon income distribution, wealth effects, employment security, and inflation expectations rather than following a simple mechanical relationship. Consumer confidence indices retain predictive value for high-level economic forecasting, but their predictive accuracy during structural shifts like the 2025 tariff regime depends critically on granular analysis of expectations components, income-specific responses, and product-category dynamics. Future research and policy analysis must disaggregate consumer confidence and spending data to understand how sentiment translates heterogeneously across income groups, and must track specific expectations components—particularly labor market and job availability metrics—as the most reliable leading indicators of actual spending weakness.