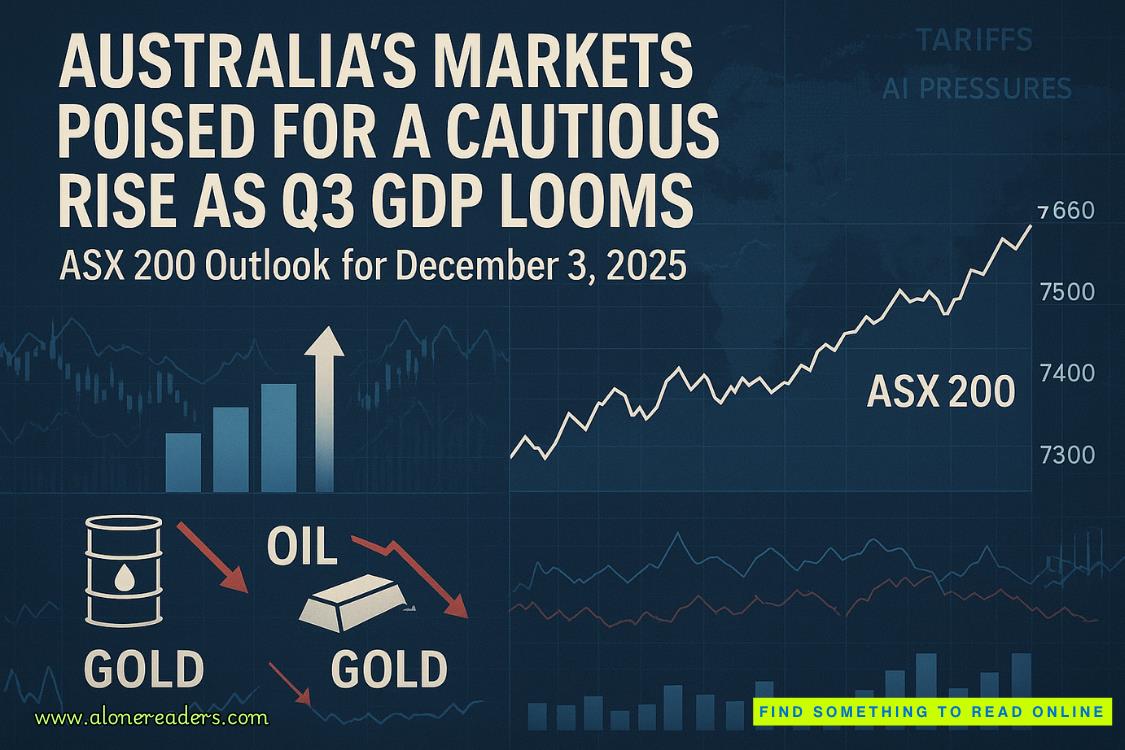

The Australian share market heads into Wednesday’s session with cautious optimism, supported by positive overnight movements on Wall Street but restrained by looming economic data and mixed signals across key commodities. SPI futures indicate the ASX 200 is set to open approximately 8 points or 0.1% higher, extending the modest 0.15% gain recorded on Tuesday. Although the projected rise is minimal, it reflects a stabilizing sentiment after several sessions marked by fluctuating risk appetite and uncertainty about the broader economic landscape.

Wall Street’s performance provided a steady lead. The Dow Jones climbed 0.45%, the S&P 500 added 0.25%, and the tech-heavy Nasdaq surged 0.65%. The US market’s resilience continues to serve as a stabilizing force for global equities, particularly as investors reassess the trajectory of interest rates, inflation pressures, and sector-specific earnings. Tech stocks have regained momentum in the US, supporting the Nasdaq’s outperformance and indirectly boosting sentiment in Australian growth and technology names.

However, the local picture is less straightforward. The key event shaping Australia’s market tone today is the Australian Bureau of Statistics’ release of Q3 GDP data. Economists widely expect the economy to have expanded by 2.2% across the year to September, with a quarterly increase of roughly 0.7%. These forecasts align closely with the Reserve Bank of Australia’s recently upgraded outlook, which revised its December GDP projection from 1.7% to 2%. Such an upward correction has placed additional attention on today’s result, as investors look for a clear narrative that either supports the RBA’s confidence or challenges it.

Despite this optimism, risks remain firmly embedded. Last week’s inflation data surprised on the upside, raising concerns that underlying price pressures may be more persistent than previously thought. If today’s GDP print falls short of expectations, the market may quickly shift its focus toward stagflation fears—a combination of weak growth and rising prices. Stagflation is among the most challenging economic conditions for equity markets, as it undermines both corporate earnings and consumer confidence while limiting the central bank’s flexibility. A softer-than-expected GDP number could therefore weigh on banks, retailers, and cyclical stocks, which are most sensitive to domestic economic conditions.

In contrast, a stronger result may reinforce the perception that Australia’s economy is holding up better than anticipated, paving the way for a more constructive market outlook into year-end. Either way, today’s GDP release is poised to serve as a key driver of market direction, especially during the morning session.

Beyond macroeconomic data, commodity markets are sending mixed but generally negative signals. Oil prices declined overnight, with WTI crude falling 1.1% to US$58.67 per barrel and Brent crude slipping 1.15% to US$62.45. These declines stem from growing concerns about global demand, particularly as key economies show uneven industrial output and the geopolitical risk premium continues to soften. For the ASX, this places pressure on energy stocks, including Beach Energy and Santos, which have already been grappling with volatile pricing and shifting forward-curve expectations. With oil drifting lower, energy equities may dampen the broader index’s early gains despite the positive futures lead.

Gold also experienced a pullback, dropping 1.1% to US$4,229 per ounce after a strong rally that pushed the metal near recent highs. Traders took profits ahead of major economic announcements, contributing to the retreat. Gold-linked equities such as Newmont and Northern Star Resources are likely to face selling pressure as investors rebalance positions and assess whether gold can maintain its upward trend amid global inflation concerns. The metal’s recent strength has been driven by both geopolitical tension and expectations of long-term monetary easing, but short-term volatility continues to disrupt sentiment.

Within the equities landscape, broker insights from Bell Potter added further nuance. Beacon Lighting received a new buy rating, accompanied by a $3.35 price target. According to the analysis, the company is positioned strongly within a recovering retail environment, benefiting from consumer demand for energy-efficient home improvement solutions and resilient discretionary spending trends. After several quarters of mixed results across retail, Beacon’s positioning reflects the broader theme of selective strength within the sector. Investors increasingly favor companies with niche markets, strong brand identity, and operational flexibility—traits that Beacon appears to embody.

Graincorp, on the other hand, was reaffirmed at hold. Although the company continues to benefit from favorable export conditions and solid production volumes, Bell Potter argues that the stock is fully valued at current levels. Graincorp has enjoyed strong performance across several seasons due to global grain supply disruptions and high demand, but with inflows stabilizing, valuation concerns are becoming more pronounced. This reflects a broader trend in Australian agriculture: strong fundamentals but limited upside unless new catalysts emerge.

Looking beyond local markets, global dynamics remain a critical influence. The OECD has warned that rising tariffs and the rapid evolution of artificial intelligence could challenge global economic resilience. The warning draws attention to two key risks. First, escalating trade tensions may disrupt supply chains and distort pricing, leading to unpredictable market movements. Second, AI adoption—while offering efficiency and growth opportunities—could have uneven impacts across sectors and labor markets, potentially triggering episodes of structural adjustment and job displacement. While Australia is somewhat insulated from the immediate effects of global tariff escalations, the interconnected nature of global trade ensures that prolonged tensions will feed into local market sentiment.

There are also continuing concerns about US fiscal sustainability, particularly as deficits widen and government spending remains elevated. A fiscally constrained United States could face increased borrowing costs, placing upward pressure on bond yields worldwide. For Australia, this would likely influence government bond markets and impact sectors sensitive to yield movements, such as property trusts and high-dividend equities.

As markets open today, investors must navigate a complex interplay of domestic economic data, commodity-driven sector pressures, and global macroeconomic uncertainty. The ASX 200’s expected rise reflects cautious optimism rather than robust confidence. Much hinges on the Q3 GDP numbers, which will either affirm the narrative of a gradually strengthening economy or introduce fresh concerns about the trajectory into 2026. Commodity-linked sectors are likely to be immediate drags, while selective opportunities in retail and defensive stocks may help balance market performance.

The overarching theme is one of measured anticipation. Though the market is set for a positive start, the day’s tone will ultimately be shaped by the GDP release and the market’s interpretation of what it means for inflation, the RBA’s future decisions, and the broader economic direction. For traders and long-term investors alike, today represents a moment where data meets sentiment, requiring careful attention and disciplined strategy as Australia’s markets begin to move.