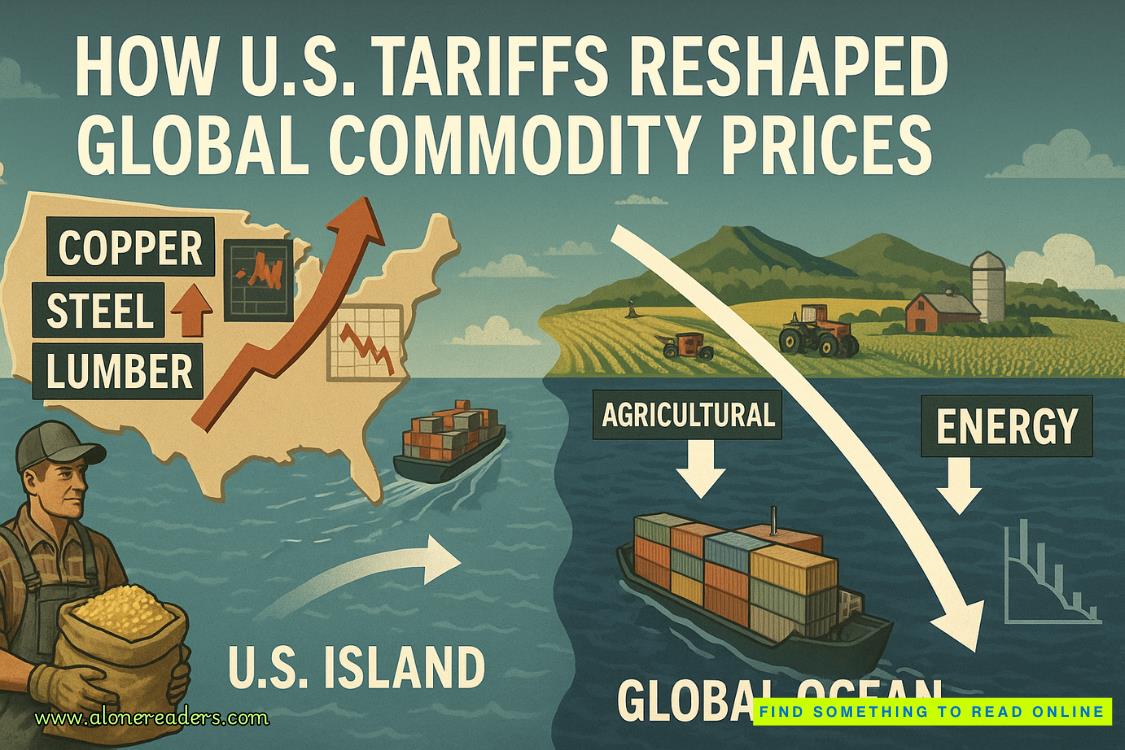

By late 2025, the global commodity system no longer behaves like a single integrated marketplace. Instead, it has fractured into two distinct price universes: an inflation-driven “US Island,” carved out by the second Trump administration’s broad tariff wall, and a softer “Global Ocean,” shaped by weakened Chinese demand and oversupplied international markets. This separation—unusual even by historical protectionist standards—has created deep distortions in metals, agriculture, energy costs, manufacturing competitiveness, and long-term trade relationships.

The defining characteristic of this bifurcation is extreme divergence. Industrial metals inside the United States have surged to record highs, while global prices have slid. Conversely, agricultural commodities tell the opposite story: U.S. farm prices have collapsed while Brazil and Argentina enjoy record foreign demand. For the first time in modern trade history, the U.S. is simultaneously experiencing commodity inflation and commodity deflation—depending on the sector.

This is not a short-term anomaly. Structural forces created by tariffs, retaliation, rerouted supply chains, and anticipatory buying behavior have created durable economic asymmetries that will continue shaping 2026 and beyond.

The clearest example of tariff-induced distortion is visible in the industrial metals market. The 2025 tariff package—10–20% broad-based duties plus sector-specific levies on steel, aluminum, and copper—effectively enclosed the U.S. in a protected bubble.

Inside that bubble, metal prices inflated aggressively. Copper became the most dramatic case: COMEX copper prices soared past $5.37 per pound (over $11,200 per tonne) as American traders scrambled to secure supply before full tariff enforcement. A panic-driven short squeeze inside the U.S. futures market propelled prices to historic levels, entirely detached from fundamentals.

Outside U.S. borders, the opposite was happening. London Metal Exchange (LME) copper prices drifted downward as China’s slowing construction and manufacturing sectors reduced global demand. Suppliers diverted shipments away from the tariff-walled U.S. and into Europe and Asia, where inventories expanded and prices softened.

The result was a staggering $3,000-per-tonne gap between U.S. and global copper prices—representing a 20% premium rarely seen in the modern trading era. Other metals displayed similar splits. U.S. hot-rolled coil steel remained 15–20% above global averages, while international steel markets sank as Asian mills redirected their exports.

For U.S. manufacturers, this divergence means paying a persistent “protection tax.” Factories producing cars, appliances, batteries, and machinery face input costs far above those of foreign competitors. This has locked structural inflation into the American manufacturing system, keeping core goods inflation roughly 2% above its long-run trend.

While U.S. metal producers benefited from the tariff wall, American farmers became its biggest victims. China, which relies on the U.S. for soybeans and corn in normal market conditions, retaliated by completely rerouting its purchasing.

Brazil and Argentina have become the new center of Chinese agricultural procurement. This shift has radically and permanently altered prices.

U.S. soybean prices collapsed under swelling domestic inventories. Storage facilities in the Midwest filled to capacity as Chinese orders evaporated. Meanwhile, Brazilian soybean exporters enjoyed unprecedented premiums—over $1.20 per bushel above U.S. prices—an extraordinary reversal of long-standing pricing dynamics where U.S. beans typically commanded equal or higher value.

Corn followed a similar trajectory. U.S. prices weakened by around $0.13 per bushel in certain models, while South American export prices increased due to concentrated Chinese demand. Brazilian farmers, already the world’s leading soybean producers, accelerated their expansion into new acreage. Investors poured capital into logistics, ports, and storage infrastructure along Brazil’s agricultural corridor.

U.S. farmers, by contrast, face the worst competitive setback in decades. Analysts increasingly warn that China’s pivot is not temporary. Even if tariffs were lifted, South America’s strengthened infrastructure, deeper buyer relationships, and scaled-up production capacity could leave U.S. agriculture with long-lasting structural market loss.

This agricultural inversion—U.S. metals inflated but U.S. grains deflated—is one of the starkest illustrations of the two-market world created by the tariff regime.

Oil is one of the few commodities exempted from the tariff program, a strategic decision meant to avoid gasoline price spikes. Yet the energy sector has not escaped the broader trade war’s effects.

Global oil prices have remained subdued due to weaker economic activity, particularly in China. Manufacturing slowdown, reduced construction, and falling freight volumes have all contributed to softer demand. As a result, Brent crude has struggled to break out of the mid-$60s per barrel range despite geopolitical tensions in multiple oil-producing regions.

In the U.S., however, the cost structure of producing oil has quietly risen. Tariffs on steel, pipes, drilling rigs, and specialized industrial equipment have increased upstream capital expenditures by an estimated 2–5%. This cost pressure has slowed the pace of new drilling projects, particularly in shale regions where profit margins are more sensitive to capital outlays.

The paradox is notable: the oil itself is tariff-free, but everything needed to extract, transport, and refine it is more expensive. This keeps U.S. supply growth capped, preventing domestic prices from falling as much

The construction sector has been hit by a combination of high interest rates and tariff-induced material spikes. The most disruptive event came in late 2025 when the U.S. government doubled duties on Canadian softwood lumber to roughly 35%.

Markets reacted instantly. Lumber futures rallied to around $575 per 1,000 board feet, reversing months of price declines. But the rally didn’t last long. A slowing housing market—burdened by mortgage rates hovering near multi-decade highs—could not support sustained price inflation. Instead of rising further, demand simply collapsed.

The lumber market became a case study in tariff-driven volatility: sharp upward price shocks followed by demand destruction rather than long-term inflation. Builders canceled or delayed projects, and construction employment levels plateaued as margins tightened.

as they otherwise might have.

The new global commodity geography has created clear beneficiaries and clear casualties.

Winners:

• Brazilian farmers, who captured China’s redirected agricultural demand and now enjoy record premiums

• Mexico and Vietnam, which absorbed manufacturing capacity relocated from China—though the U.S. is tightening controls on transshipment workarounds

• U.S. steel and copper producers, protected from foreign competition and benefiting from higher domestic prices

Losers:

• U.S. consumers and manufacturers, who now face world-leading input costs for metals, lumber, and equipment, increasing prices for cars, houses, and appliances

• U.S. farmers, who have lost their largest export market and face the lowest price competitiveness in modern history

• China and Germany, whose export-heavy industries face global deflationary pressures as unsold products are dumped in non-U.S. markets at lower prices

The overall outcome is a world where commodity pricing no longer reflects global supply and demand alone, but rather political boundaries, retaliatory trade dynamics, and regionally isolated supply chains.

Most analysts expect the two-market world to persist into 2026. Tariffs have fundamentally reshaped sourcing strategies, shipping routes, and investment decisions across multiple sectors. Even if policies shift in the future, the new supply chains and relationships—particularly in agriculture—are unlikely to unwind quickly.

The greatest emerging risk is demand destruction inside the United States. Historically, commodity price inflation in metals and construction materials has preceded manufacturing slowdowns. With U.S. producers paying premium prices while competitors abroad access cheaper inputs, the risk is less about supply shocks and more about eroding competitiveness, reduced output, and postponed investment.

Globally, the story is the opposite: excess supply, lower prices, weaker growth. This deflationary environment, amplified by China’s slowdown, will continue dragging down global commodity prices—even as the U.S. remains locked in its high-cost island economy.

In short, tariffs have not merely altered trade flows—they have redrawn the global economic map. A fractured commodity world is now the defining reality of the late 2020s, and its consequences will shape everything from farm incomes to housing prices to geopolitical alliances in the years ahead.